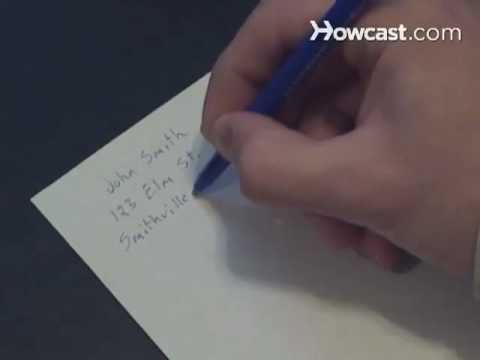

How to address an envelope correctly so it reaches its destination. You will need a pen, an envelope, a return address, and the recipient's information. Step 1: Write the return address, the sender's address, at the top left corner of the envelope. Include the sender's full name on the first line, street address or post office on the next line, and city, state, and five-digit zip code on the third line. Write legibly so that postal workers can read it. Step 2: Write the recipient's information in the center of the envelope. Write their name on the first line, street address or post office on the second line, and city, state, and five-digit zip code on the third line. Adding the additional plus four digits to the zip code can be found at usps.com/smallbiz. On average, there are 667 million pieces of mail each day.

Award-winning PDF software

Mailing address for 4852 Form: What You Should Know

Form 4852 is a substitute form for Form W-2. Form 4852: The Instructions to Fill it Right is an information tool for employers. You can request that IRS form 4852 be completed for you. The form comes with instructions and a form called Form 4852 that you fill or sign, and return to the IRS. However, it is best to do it yourself and mail in your request. You need to fill in the IRS form, file it online, and submit with your tax return. This information applies to the following form(s) of W-2: Forms 1099, 1099A, 1099-MISC, 1099Q, 1099-INT, 1099-R, 1099-R-E, 1099R-Y, and 1099X If you are a nonresident alien, and you receive wages from a foreign country, and you have a nonresident alien payee, you may be eligible for a withholding exemption. A resident of a foreign country is generally a foreign corporation. Generally, wages paid from the United States to a nonresident alien by a foreign corporation will generally be excluded, unless you also have a nonresident alien payee. If you are a nonresident alien, and you have a nonresident alien payee, you may be eligible for a withholding exemption. See Form 8854, Nonresident Alien Tax Return, to determine if your withholding will be deductible from your tax. The withholding tax rules differ based on whether you are filing an individual (i.e., nonresident alien) or a corporation (i.e., resident). If you are resident, you may be able to claim a tax credit for withholding taxes withheld to the U.S., or for withholding tax that you have to pay to a foreign country where the U.S. corporate office is located. If you are not resident, you may have to pay taxes directly to the country where you conduct your business. Nonresident alien payees need to complete Form 5498-W. Send Form 4852 to your nonresident alien payee before April 15th of the following tax year to claim a credit for withholding taxes. What Does Form 4852 Do? Form 4852 replaces Form W-2 for nonresident aliens.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 4852, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 4852 Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 4852 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 4852 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Mailing address for Form 4852